Comprehensive Evaluation of the Refine of Offshore Business Formation for Tax Efficiency

Browsing the details of overseas business development for tax efficiency requires a careful strategy that includes various elements, from picking the ideal territory to making certain conformity with monetary and legal regulations. The appeal of tax obligation benefits usually drives businesses to check out overseas options, yet the process includes greater than just developing a company in an international land. By analyzing the subtleties of jurisdiction selection, lawful responsibilities, economic strategies, and tax ramifications, a comprehensive understanding can be obtained to optimize tax obligation performance. As we explore the complexities of offshore business formation, a much deeper insight into the prospective mistakes and strategic maneuvers waits for.

Choosing the Right Territory

Some territories have no company tax, while others provide reduced or special tax obligation rates for international services. Comprehending the tax obligation ramifications can dramatically impact the total tax obligation efficiency of the offshore company.

Furthermore, the legal structure and regulatory atmosphere of the chosen territory play an important role in the success and conformity of the overseas business. It is necessary to examine aspects such as personal privacy legislations, reporting demands, and simplicity of company development in the picked jurisdiction. Making certain placement in between the firm's purposes and the territory's lawful structure can aid maximize and minimize dangers tax efficiency.

Additionally, considering the economic and political stability of the territory is crucial for long-term preparation and sustainability of the offshore company. Stability fosters capitalist self-confidence, secures properties, and guarantees connection of procedures. By carefully analyzing these factors, entrepreneurs can make an informed choice when selecting the ideal jurisdiction for their offshore company, ultimately making best use of tax efficiency and regulatory conformity.

Understanding Legal Needs

When developing an overseas firm for tax obligation efficiency, a comprehensive understanding of the lawful needs is essential for ensuring conformity and mitigating threats. In addition, recognizing the tax obligation regulations and reporting responsibilities in the chosen territory is necessary for preserving openness and adhering to regulatory criteria. By comprehensively understanding and adhering to the legal demands linked with overseas firm development, individuals and companies can establish a strong foundation for tax obligation efficiency while decreasing lawful risks.

Financial Considerations and Preparation

With a solid understanding of the lawful needs bordering offshore company development for tax effectiveness, the next vital action includes meticulous financial factors to consider and strategic preparation. Financial preparation in the context of setting up an offshore company calls for a thorough evaluation of different factors. One vital element is figuring out the first resources required to develop the overseas entity, taking into consideration enrollment costs, functional expenses, and any kind of minimal funding needs in the selected territory. Additionally, it is essential to establish a comprehensive budget plan that includes ongoing costs such as workplace lease, employee incomes, and important link other expenses.

It is critical to take into consideration the long-lasting economic goals of the overseas business and line up the financial planning methods as necessary to ensure lasting tax effectiveness over time. By carefully examining monetary factors to consider and planning strategically, businesses can optimize the benefits of offshore business development for tax obligation effectiveness.

Tax Obligation Implications and Advantages

Effectively navigating the tax implications and benefits is crucial when developing an offshore business for optimum economic management. Offshore business commonly offer positive tax advantages, such as lower company tax rates, tax obligation exceptions on certain types of income, and possession protection advantages. By purposefully structuring the offshore business in territories with positive tax obligation laws, companies can legitimately minimize their tax commitments and boost their general success.

One considerable tax obligation benefit of offshore firm formation is the capability to decrease or eliminate particular tax obligations on foreign-sourced earnings. This can result in substantial cost savings for services participated in worldwide trade or financial investment tasks. In addition, overseas business can promote tax preparation approaches that help reduce tax obligations with legitimate official source means, guaranteeing compliance with appropriate tax obligation regulations while optimizing tax obligation performance.

Conformity and Coverage Responsibilities

Making sure conformity with regulative needs and satisfying reporting responsibilities are paramount factors to consider for services operating via overseas firm frameworks. Offshore territories typically have details regulations and laws that companies need to stick to, consisting of preserving precise financial documents, sending annual returns, and carrying out normal audits. Failing to adhere to these demands can result in extreme penalties, loss of reputation, and even the dissolution of the offshore entity.

Among the key compliance responsibilities for offshore firms is to make sure that they are not entailed in any type of illegal tasks such as money laundering or tax obligation evasion. Boosted due diligence procedures, Know Your Customer (KYC) treatments, and Anti-Money Laundering (AML) checks are typically called for to stop immoral economic activities.

Along with governing conformity, offshore firms have to likewise meet reporting obligations to try this web-site appropriate authorities. This frequently includes sending economic statements, tax obligation returns, and various other documentation to demonstrate transparency and responsibility. By satisfying these conformity and reporting demands, companies can preserve their excellent standing, build trust fund with stakeholders, and reduce prospective risks related to offshore procedures.

Final Thought

To conclude, the procedure of overseas business development for tax efficiency entails careful factor to consider of territory selection, legal needs, economic planning, tax obligation effects, and compliance commitments. By understanding these aspects and making notified choices, organizations can gain from minimized tax responsibilities and boosted financial flexibility. It is vital to seek expert assistance to make certain conformity with laws and make best use of the benefits of overseas structures.

Comprehending the tax obligation effects can considerably affect the general tax effectiveness of the overseas business. (offshore company formation)

In addition, offshore business can promote tax preparation techniques that help minimize tax liabilities with reputable ways, making certain conformity with relevant tax regulations while making best use of tax obligation efficiency. offshore company formation.

In final thought, the procedure of overseas business development for tax effectiveness includes careful factor to consider of territory choice, legal demands, financial preparation, tax ramifications, and conformity obligations.

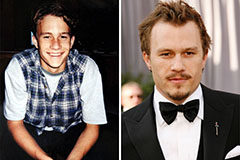

Heath Ledger Then & Now!

Heath Ledger Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!